Expert Due Diligence Investigations for Business Safety

Comprehensive Due Diligence Investigations by Private Investigators

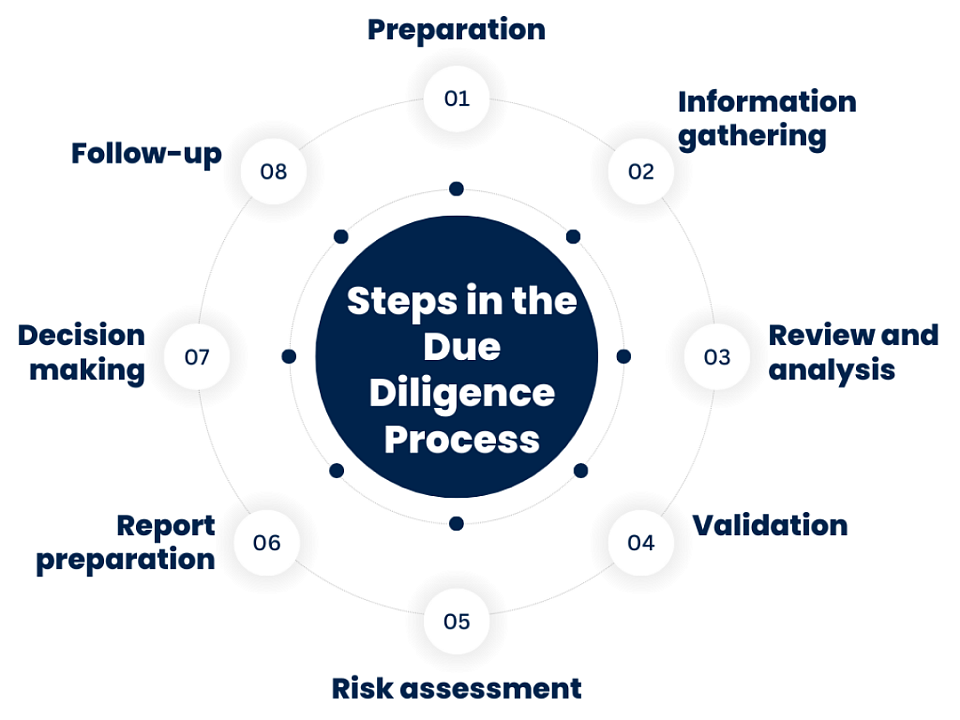

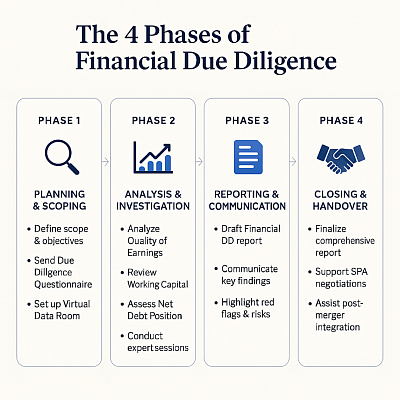

A private investigator's due diligence investigation systematically verifies the credibility, financial health, and reputation of a business or individual before a major transaction, partnership, or investment. Unlike a standard financial audit, a PI's inquiry uses various investigative techniques to identify risks and potential fraud that public records alone might not reveal.

Key Areas of Investigation in Due Diligence

The scope of a due diligence investigation is customized to a client's specific needs but typically includes:

• Corporate due diligence: Investigating the legal, financial, and operational aspects of a company before a merger, acquisition, or joint venture. This includes verifying assets, liabilities, and corporate structure.

• Background checks: Vetting key executives, potential business partners, and employees to uncover any criminal history, fraud, or unethical business practices.

• Financial health analysis: Examining a target's financial statements, identifying hidden debts or revenue inconsistencies, and scrutinizing assets and cash flow.

• Reputational due diligence: Assessing a target's public reputation through media screening, analyzing past business dealings, and interviewing clients, suppliers, and former employees.

• Compliance checks: Ensuring adherence to regulations like anti-money laundering (AML) and anti-corruption laws.

• Asset searches: Locating assets and real estate for financial evaluations.

• Intellectual property review: Investigating any potential intellectual property infringement or disputes.

Advanced Methods Employed by Private Investigators

Private investigators use a range of legal and ethical methods to gather information for a due diligence report:

• Public records search: Accessing governmental registries, corporate filings, litigation records, and financial databases to verify claims and uncover potential liabilities.

• Surveillance: Conducting observation to verify information or detect undisclosed activities.

• Interviews: Speaking with business associates, employees, and other stakeholders to collect first-hand qualitative information.

• Forensic accounting: Analyzing financial records for signs of fraud or inconsistencies.

• Digital tracking: Using advanced technology and proprietary methods to trace complex corporate and ownership structures, including shell entities and offshore holdings.

• Open-source intelligence (OSINT): Sifting through online information, social media, and media reports to build a reputational profile.

Understanding Legal and Ethical Boundaries in Investigations

Reputable private investigators must operate within the legal and ethical boundaries of their jurisdiction. In South Africa, for example, they must be registered with the Private Security Industry Regulatory Authority (PSiRA). Critical legal limits include:

• Respecting privacy: Investigators cannot conduct unlawful surveillance on private property without consent or intercept private communications like emails or phone calls.

• Admissibility of evidence: Evidence gathered illegally, such as through trespassing or hacking, will be inadmissible in court.

• No impersonation: Impersonating law enforcement is a serious offense.

• Data protection: Strict adherence to data protection laws, such as the Protection of Personal Information (POPI) Act, is required.

Benefits of Engaging a Professional Private Investigator

While some due diligence can be done in-house, a professional PI offers several benefits:

• Expertise: PIs are experienced in finding, analyzing, and verifying information from a wide variety of sources, including those not accessible to the public.

• Risk mitigation: They can uncover hidden liabilities, fraudulent activities, and other "red flags" to protect a client from financial, legal, and reputational damage.

• Time and cost savings: Professionals can complete the process efficiently, freeing up a client's resources and helping them avoid costly mistakes.

• Informed decisions: The comprehensive report provides clients with actionable intelligence to make sound business decisions.